|

Where Tax Brackets Apply. . . . Your tax bracket is the rate you pay on the "last dollar" you earn; but as a percentage of your income, your tax rate is generally less than that. First, here are the tax rates and the income ranges where they apply: . and. %. . and. %. and. %. and. %. and. %. To take an example, suppose your taxable income (after deductions and exemptions) is exactly $100,000 in 2012 and your status is Married filing jointly; then your tax would be calculated like this: . (. $ 17,400 Show

Top 1: Tax Brackets (Federal Income Tax Rates) 2000 through 2022 …Author: moneychimp.com - 112 Rating

Description: Where Tax Brackets Apply Your tax bracket is the rate you pay on the "last dollar" you earn; but as a percentage of your income, your tax rate is generally less than that. First, here are the tax rates and the income ranges where they apply: . and. % and. %. and. %. and. %. and. %. To take an example, suppose your taxable income (after deductions and exemptions) is exactly $100,000 in 2012 and your status is Married filing jointly; then your tax would be calculated like this: . (. $ 17,400

Matching search results: WebFederal Tax Brackets. Your tax bracket is the rate you pay on the "last dollar" you earn; but as a percentage of your income, your tax rate is generally less than that. ... 1993 saw a tax hike on the wealthy (via two new brackets at the top), and then 2001 through 2003 saw a series of tax cuts that lowered the tax brackets as follows: 1992: 1993 - ...

Top 2: 2021-2022 Tax Brackets and Federal Income Tax Rates | BankrateAuthor: bankrate.com - 106 Rating

Description: How federal tax brackets work. Marginal tax rate definition and example. How to get into a lower tax bracket. Tax brackets from previous years:. Essential tax reading: . topseller/Shutterstock.comThere are seven tax brackets for most. ordinary income for the 2021 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.Your tax bracket depends on your taxable income and your filing status: single, married. filing jointly or qualifying widow(er), married fili

Matching search results: WebApr 07, 2022 · There are seven tax brackets for most ordinary income for the 2021 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket depends on your taxable income and your filing status: single ... ...

Top 3: 2021 Tax Brackets | 2021 Federal Income Tax Brackets & RatesAuthor: taxfoundation.org - 104 Rating

Description: 2021 Federal Income Tax Brackets and Rates. Standard Deduction and Personal Exemption. Alternative Minimum Tax (AMT). Earned Income Tax Credit (EITC). Capital Gains Tax. Rates (Long-Term Capital Gains). Qualified Business Income Deduction (Sec. 199A). Annual Exclusion for Gifts. Confused? Boost Your Tax Knowledge with TaxEDU. Help Us Learn More About How Americans Understand Their Taxes On a yearly basis the IRS adjusts more than 40 tax provisions for inflation. This is done to prevent what is c

Matching search results: WebOct 27, 2020 · A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. ...

Top 4: 2020 Tax Brackets | 2020 Federal Income Tax Brackets & RatesAuthor: taxfoundation.org - 104 Rating

Description: 2020 Federal Income Tax Brackets and Rates. Standard Deduction and Personal Exemption. Alternative Minimum Tax. Earned Income Tax Credit. Capital Gains Tax Rates (Long Term Capital Gains). Qualified Business Income Deduction (Sec. 199A). Annual Exclusion for Gifts. Confused? Boost Your Tax Knowledge with TaxEDU See New Tax BracketsOn a yearly basis the IRS adjusts more than 40 tax provisions for inflation. This is done to prevent what is called “bracket creep,” when people are pushed into highe

Matching search results: WebNov 14, 2019 · A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. ...

Top 5: 2022 and 2023 Tax Brackets: Find Your Federal Tax Rate Schedules - TurboTaxAuthor: turbotax.intuit.com - 171 Rating

Description: 2022 Tax Brackets and Tax Rates (for filing in 2023). 2023 Tax Brackets and Tax Rates (for filing in 2024). TurboTax Will Do It For You. TaxCaster Tax. Calculator. Tax Bracket Calculator. W-4 Withholding Calculator. Self-Employed Tax Calculator. Self-Employed Tax Deductions Calculator TopTurboTax /Tax Calculators & Tips /Tax Tips Guides & Videos /IRS Tax Return /2022 and 2023 Tax Brackets: Find Your Federal Tax Rate SchedulesUpdated for Tax Year 2022 • December 1, 2022 09:03 AMOVERVIEW

Matching search results: WebDec 01, 2022 · Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back: If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Online Free Edition customers are entitled to payment of $30.) ...

Top 6: 2019-2020 Tax Brackets | 2019 Federal Income Tax BracketsAuthor: taxfoundation.org - 101 Rating

Description: Income Tax Brackets and Rates. Standard Deduction and Personal Exemption. Alternative Minimum Tax. Earned Income Tax Credit. Qualified Business Income Deduction (Sec. 199A). Annual Exclusion for Gifts. Confused? Boost Your Tax Knowledge with TaxEDU See New Tax BracketsOn a yearly basis the IRS adjusts more than 40 tax provisions for inflation. This is done to prevent what is called “bracket creep,” when people are pushed into higher income tax brackets or have. reduced value from credits and ded

Matching search results: WebNov 28, 2018 · A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. ...

Top 7: Federal Tax Rates & BracketsAuthor: taxfoundation.org - 102 Rating

Description: 2023 Tax Brackets and Rates. Standard Deduction and Personal Exemption. Alternative Minimum Tax (AMT). Earned Income Tax Credit (EITC). Capital Gains Tax Rates & Brackets (Long-term Capital Gains). Qualified Business Income Deduction (Sec. 199A). Annual Exclusion for Gifts. Confused? Boost Your Tax Knowledge with TaxEDU. Help Us Learn More About How Americans Understand Their Taxes On a yearly basis the Internal Revenue Service (IRS) adjusts more than 60 tax provisions for inflation to prevent

Matching search results: WebOct 18, 2022 · Note that the Tax Foundation is a 501(c)(3) educational nonprofit and cannot answer specific questions about your tax situation or assist in the tax filing process. 2023 Tax Bracket s and Rates In 2023, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). ...

Top 8: Canada Taxes 2022: Federal Tax Brackets, Rates and CreditsAuthor: turbotax.intuit.ca - 126 Rating

Description: What are tax brackets?. How does Canada’s personal income tax brackets work?. What are combined federal and provincial tax rates?. Provincial tax brackets rates for Tax Year 2022. Why does your tax bracket matter?. How do you get into a lower tax bracket?. How much federal tax do I have to pay based on my income?. What are marginal tax rates? What are tax brackets?Tax brackets are created by the CRA to determine how much money you need to pay in personal income tax every year. Tax brackets appl

Matching search results: WebAug 12, 2022 · What are tax brackets? Tax brackets are created by the CRA to determine how much money you need to pay in personal income tax every year. Tax brackets apply to personal income earned between predetermined minimum and maximum amounts, also called tax rates. In other words, a tax bracket is the tax rate applicable to a set range of … ...

Top 9: 2022 Tax Brackets and Federal Income Tax Rates | Tax FoundationAuthor: taxfoundation.org - 107 Rating

Description: 2022 Federal Income Tax Brackets and Rates. Standard Deduction and Personal Exemption. Alternative Minimum Tax (AMT). Earned Income Tax Credit (EITC). Capital Gains. Tax Rates & Brackets (Long-term Capital Gains). Qualified Business Income Deduction (Sec. 199A). Annual Exclusion for Gifts. Confused? Boost Your Tax Knowledge with TaxEDU. Help Us Learn More About How Americans Understand Their Taxes See 2023 Tax BracketsOn a yearly basis the Internal Revenue Service (IRS) adjusts more than 60 tax

Matching search results: WebNov 10, 2021 · The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income … ...

Top 10: How do federal income tax rates work? | Tax Policy CenterAuthor: taxpolicycenter.org - 139 Rating

Description: CURRENT INCOME TAX RATES AND BRACKETS. BASICS OF PROGRESSIVE INCOME TAXATION. HISTORY OF FEDERAL INCOME TAX BRACKETS AND RATES CURRENT INCOME TAX RATES AND BRACKETSThe federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions. Income up to the standard deduction (or itemized deductions) is thus taxed at a zero rate.Federal income t

Matching search results: WebThe federal income tax began with seven brackets but that number exploded to more than 50 by 1920 (figure 1). From then until the late 1970s, there were never fewer than 20 brackets. The last major federal tax reform, the Tax Reform Act of 1986, reduced the number of brackets from 16 to two, but that number has crept up to the current seven ... ...

Top 11: Tax Brackets and Federal Income Tax Rates: 2022-2023 - NerdWalletAuthor: nerdwallet.com - 133 Rating

Description: 2022 federal income tax brackets. 2023 federal income tax brackets. How tax brackets work. What is a marginal tax rate?. How to get into a lower tax bracket and pay a lower federal income tax rate. 2019 Federal Income Tax Brackets. 2018 Federal Income Tax Brackets. 2017 Federal Income Tax Brackets. 2016 Federal Income Tax Brackets. 2015 Federal Income Tax Brackets. 2014 Federal Income Tax Brackets. 2013 Federal Income Tax Brackets. 2012 Federal Income Tax Brackets. Past years' tax brackets Ther

Matching search results: Oct 20, 2022 · There are seven federal tax brackets for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable ...Tax Credits vs. Tax Deductions · Tax Deductions · Capital Gains Tax · CalculatorOct 20, 2022 · There are seven federal tax brackets for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable ...Tax Credits vs. Tax Deductions · Tax Deductions · Capital Gains Tax · Calculator ...

Top 12: 2022-2023 Tax Brackets And Federal Income Tax Rates - ForbesAuthor: forbes.com - 130 Rating

Description: The 2022 Income Tax Brackets (Taxes due April 2023). The 2023 Income Tax Brackets (Taxes due April 2024). What Are Tax Brackets?. How To Figure Out Your Tax Bracket. How To Get Into a Lower Tax Bracket. Compare the best tax software of 2022. How Tax Brackets and Rates Have Evolved Over the Past 10 Years. 2021 Federal Income Tax Brackets 2020 Federal Income Tax Brackets . 2019 Federal Income Tax Brackets . 2018 Federal Income Tax Brackets . 2017 Federal Income Tax Brackets . 2016 Federal Income Tax Brackets . 2015 Federal Income Tax Brackets . 2014 Federal Income Tax Brackets . 2013 Federal Income Tax Brackets . 2012 Federal Income Tax Brackets .

Matching search results: Dec 6, 2022 · For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing ...Dec 6, 2022 · For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing ... ...

Top 13: What Are the Income Tax Brackets for 2022 vs. 2023? - KiplingerAuthor: kiplinger.com - 134 Rating

Description: Subscribe to Kiplinger’s Personal Finance. Sign up for Kiplinger’s Free E-Newsletters. 2022 Tax Rates and Brackets. 2023 Tax Rates and Brackets. Inflation's Impact on the 2023 Brackets. How the Tax Brackets Work. Capital Gains Tax Rates When it comes to federal income tax rates and brackets, the tax rates themselves aren't changing from 2022 to 2023. The same seven tax rates in effect for the 2022 tax year – 10%, 12%, 22%, 24%, 32%, 35% and 37% – still apply for 2023. However, the tax brackets

Matching search results: 5 days ago · 2022 Tax Rates and Brackets ; 10%, Up to $10,275, Up to $20,550 ; 12%, $10,276 to $41,775, $20,551 to $83,550 ; 22%, $41,776 to $89,075, $83,551 to ...5 days ago · 2022 Tax Rates and Brackets ; 10%, Up to $10,275, Up to $20,550 ; 12%, $10,276 to $41,775, $20,551 to $83,550 ; 22%, $41,776 to $89,075, $83,551 to ... ...

Top 14: 2021-2022 Tax Brackets and Federal Income Tax Rates | BankrateAuthor: bankrate.com - 106 Rating

Description: How federal tax brackets work. Marginal tax rate definition and example. How to get into a lower tax bracket. Tax brackets from previous years:. Essential tax reading: . topseller/Shutterstock.comThere are seven tax brackets for most. ordinary income for the 2021 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.Your tax bracket depends on your taxable income and your filing status: single, married. filing jointly or qualifying widow(er), married fili

Matching search results: Apr 7, 2022 · There are seven tax brackets for most ordinary income for the 2021 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, ...Apr 7, 2022 · There are seven tax brackets for most ordinary income for the 2021 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, ... ...

Top 15: Inflation-Adjusted Federal Tax Rates and Tax BracketsAuthor: taxfoundation.org - 127 Rating

Description: 2023 Tax Brackets and Rates. Standard Deduction and Personal Exemption. Alternative Minimum Tax (AMT). Earned Income Tax Credit (EITC). Capital Gains Tax Rates & Brackets (Long-term Capital Gains). Qualified Business Income Deduction (Sec. 199A). Annual Exclusion for Gifts. Confused? Boost Your Tax Knowledge with TaxEDU. Help Us Learn More About How Americans Understand Their Taxes On a yearly basis the Internal Revenue Service (IRS) adjusts more than 60 tax provisions for inflation to prevent

Matching search results: There are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.There are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. ...

Top 16: 2022 and 2023 Tax Brackets: Find Your Federal Tax Rate SchedulesAuthor: turbotax.intuit.com - 160 Rating

Description: 2022 Tax Brackets and Tax Rates (for filing in 2023). 2023 Tax Brackets and Tax Rates (for filing in 2024). TurboTax Will Do It For You. TaxCaster Tax. Calculator. Tax Bracket Calculator. W-4 Withholding Calculator. Self-Employed Tax Calculator. Self-Employed Tax Deductions Calculator TopTurboTax /Tax Calculators & Tips /Tax Tips Guides & Videos /IRS Tax Return /2022 and 2023 Tax Brackets: Find Your Federal Tax Rate SchedulesUpdated for Tax Year 2022 • December 1, 2022 09:03 AMOVERVIEW

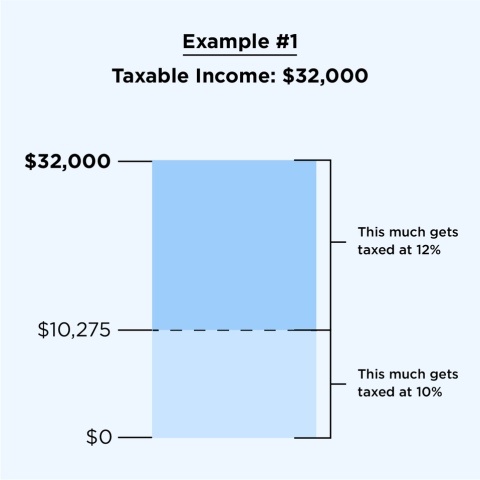

Matching search results: Dec 1, 2022 · 2022 and 2023 Tax Brackets: Find Your Federal Tax Rate Schedules ; $10,275 · $41,775, $1,027.50 plus 12% of the amount over $10,275 · $89,075 ...Dec 1, 2022 · 2022 and 2023 Tax Brackets: Find Your Federal Tax Rate Schedules ; $10,275 · $41,775, $1,027.50 plus 12% of the amount over $10,275 · $89,075 ... ...

Top 17: What is My Tax Bracket? - TurboTax Tax Tips & Videos - IntuitAuthor: turbotax.intuit.com - 145 Rating

Description: What is a tax bracket?. What are the 2021 federal income tax brackets?. What are the 2022 federal income tax brackets?. How do tax brackets work?. How does my filing status affect my tax bracket?. What is a marginal tax rate?. How do I figure out what my. marginal tax rate/tax bracket is?. What is an effective tax rate?. Which is more important, marginal or effective tax rate?. Ways to get into a lower tax bracket. How do deductions affect your tax bracket?. How do tax credits affect your tax bracket?. The type of taxable income matters. TaxCaster Tax Calculator. Tax Bracket. Calculator. W-4 Withholding Calculator. Self-Employed Tax Calculator. Self-Employed Tax Deductions Calculator.

Matching search results: Dec 1, 2022 · The term "tax bracket" refers to the income ranges with differing tax rates applied to each range. When figuring out what tax bracket you're in, ...Dec 1, 2022 · The term "tax bracket" refers to the income ranges with differing tax rates applied to each range. When figuring out what tax bracket you're in, ... ...

Top 18: Federal Income Tax Brackets for the 2022 Tax Year (Filed in 2023)Author: smartasset.com - 129 Rating

Description: The Federal Income Tax Brackets. How Federal Tax Brackets Work. Understanding the Current Federal Income Tax Brackets. How the Marginal Tax Rate Works Tap on the profile icon to edityour financial details. . The federal income tax rates remain unchanged for the 2022 tax year are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The income thresholds for each bracket, though, are adjusted slightly every year for inflation. Read on for more about the federal income tax brackets for Tax Year 2022 (filed by

Matching search results: Nov 18, 2022 · The U.S. currently has seven federal income tax brackets, with rates of 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you're one of the lucky few to ...Nov 18, 2022 · The U.S. currently has seven federal income tax brackets, with rates of 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you're one of the lucky few to ... ...

Top 19: IRS provides tax inflation adjustments for tax year 2023Author: irs.gov - 141 Rating

Description: Highlights of changes in Revenue Procedure 2022-38. Items unaffected by indexing EnglishEspañol中文. (简体)中文 (繁體)한국어РусскийTiếng ViệtKreyòl ayisyenIR-2022-182, October 18, 2022WASHINGTON — The Internal Revenue Service today announced the tax year 2023 annual inflation adjustments for more than 60. tax provisions, including the tax rate schedules and other tax changes. Revenue Procedure 2022-38PDF provides details about these annual adjustments.New for 2023The Inflation. Reduction Act extended certa

Matching search results: Oct 18, 2022 · Highlights of changes in Revenue Procedure 2022-38 · 35% for incomes over $231,250 ($462,500 for married couples filing jointly); · 32% for ...Oct 18, 2022 · Highlights of changes in Revenue Procedure 2022-38 · 35% for incomes over $231,250 ($462,500 for married couples filing jointly); · 32% for ... ...

Top 20: IRS provides tax inflation adjustments for tax year 2022Author: irs.gov - 141 Rating

Description: Highlights of changes in Revenue Procedure 2021-45: IR-2021-219, November 10, 2021WASHINGTON — The Internal Revenue Service today announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes.. Revenue Procedure 2021-45PDF provides details about these annual adjustments.Highlights of changes in Revenue Procedure 2021-45:The tax year 2022 adjustments described below. generally apply to tax returns filed in 2023.The

Matching search results: Nov 10, 2021 · 32% for incomes over $170,050 ($340,100 for married couples filing jointly); 24% for incomes over $89,075 ($178,150 for married couples filing ...Nov 10, 2021 · 32% for incomes over $170,050 ($340,100 for married couples filing jointly); 24% for incomes over $89,075 ($178,150 for married couples filing ... ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 en.apacode Inc.